Alaska

Notice to Employees - Unemployment Insurance

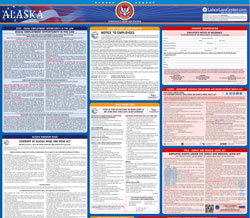

Mandatory

Alaska

Notice to Employees - Unemployment Insurance

Mandatory

The Notice to Employees - Unemployment Insurance is an Alaska unemployment law poster provided for businesses by the Alaska Department Of Labor and Workforce Development. This is a required poster for all Alaska employers, and any business that fails to post this notification may be subject to penalties or fines.

This mandatory notice to employees is a summary of the unemployment insurance rights guaranteed under Alaskan law. It gives specific details on how employees and employers are responsible for wages and taxes. In addition, qualifications are listed for those unsure whether they qualify or not. The poster also includes the contact information for filing a claim or asking a question.

Notice to Employees As an employee of this company, you are covered by Unemployment Insurance (UI). The UI program is administered by the Division of Employment and Training Services of the Alaska Department of Labor and Workforce Development. The purpose of UI is to provide partial replacement of wages between jobs. If a business has to reduce wages or hours, or temporarily lay off workers, UI gives workers financial security and temporary buying power so they can remain in the community. This, in turn, helps employers keep their trained work force. UI payments protect the economy in Alaska's communities until unemployed workers are reemployed. UI helps to reduce the family and community problems caused by layoffs or a lack of jobs. You and your employer both pay your UI premiums (taxes). You pay about 27 percent and your employer pays 73 percent. Generally speaking, if you receive one week of UI benefits, you receive as much or more than you paid into the program for the year. Your employer may withhold from your earnings the employee portion of the UI tax. Wages in excess of the maximum annual taxable wage set for the calendar year are non-taxable. Current and past years’ maximum annual taxable wage base and the employee portion of the UI tax rates are posted on the Employment Security Tax website at: labor.alaska.gov/estax/faq/w1.htm. As with any insurance, you must meet certain qualifications to be eligible for benefits. You must have earned wages in jobs that are covered by the law, file your claim for UI, and register for work with the Alaska Employment Service or your union. You must also be ready, willing and able to accept suitable work. If you quit or are fired from your last job, or if anything is keeping you from accepting full-time work, you may not immediately be eligible for benefits. To file a NEW claim or REOPEN an existing Alaska claim for UI benefits on the Internet, go to labor.alaska.gov and click on “File Unemployment Benefits Online.” To file for UI by telephone and for all other UI assistance, contact your local UI claim center. The phone numbers are listed below. If you do not reside in one of the cities below, use the toll free number. Anchorage: Fairbanks: (907) 269-4700 (907) 451-2871 Juneau/outside Alaska: All other areas in Alaska: (907) 465-5552 (888) 252-2557 The toll-free telephone number to connect to Alaska Relay is (800) 770-8973 or voice (800) 770-8255. You may be entitled to a refund of excess employee contributions to the UI Trust Fund if you had two or more employers in a calendar year, your withholdings exceeded the maximum annual employee tax and your overpayment is $5 or greater. For the year you are claiming a refund, the filing deadline for your application is Dec. 31 of the following calendar year. (If you had more than the legal maximum employee deduction withheld by any one employer, your employer is responsible for refunding this excess deduction to you.) To obtain an Employee Application for Refund, write the Alaska Department of Labor and Workforce Development, P.O. Box 115509, Juneau, AK 99811-5509 or email Tax at: [email protected] or download the form at: labor.alaska.gov/estax/forms/toc_forms.htm. Alaska’s Unemployment Insurance Program is 100 percent funded by U.S. Department of Labor through a grant award totaling $25,815,406. We are an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities. Alaska employers are required by law to post this notice. Form 07-1012 (Rev. 12/24)

Get an Alaska all-in-one labor law poster

Instead of printing out pages of mandatory Alaska and Federal labor law posters, you can purchase a professional, laminated all-in-one labor law poster that guarantees compliance with all Alaska and federal posting requirements. Fully updated for January 2017!

Get All-In-One Poster Now

More Alaska Labor Law Posters

10 PDFS

10 PDFS

Minimum-Wage.org provides an additional nine required and optional Alaska labor law posters that may be relevant to your business. Be sure to also print and post all required state labor law posters, as well as all of the mandatory federal labor law posters.

| Alaska Poster Name | Poster Type |

|---|---|

| Required Notice to Employees - Unemployment Insurance | Unemployment Law |

| Required Emergency Information | Miscellaneous Law |

| Required Summary of Alaska Wage & Hour Act | Minimum Wage Law |

| Required Safety and Health Protection on the Job Poster | Job Safety Law |

| Required USERRA - The Uniformed Services Employment and Reemployment Rights Act | General Labor Law Poster |

List of all 10 Alaska labor law posters

List of all 10 Alaska labor law posters

Alaska Labor Law Poster Sources:

- Original poster PDF URL: https://labor.alaska.gov/lss/forms/1012.pdf

, last updated May 2020

, last updated May 2020 - Alaska Labor Law Poster Page at http://www.labor.state.ak.us/lss/posters.htm

- Alaska Department Of Labor and Workforce Development at http://www.labor.state.ak.us/lss/home.htm

Labor Poster Disclaimer:

While Minimum-Wage.org does our best to keep our list of Alaska labor law posters updated and complete, we provide this free resource as-is and cannot be held liable for errors or omissions. If the poster on this page is out-of-date or not working, please send us a message and we will fix it ASAP.