Summary of Alaska Wage & Hour Act Poster

Mandatory

Summary of Alaska Wage & Hour Act Poster

Mandatory

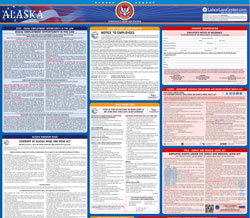

The Summary of Alaska Wage & Hour Act is an Alaska minimum wage law poster provided for businesses by the Alaska Department Of Labor and Workforce Development. This is a required poster for all Alaska employers, and any business that fails to post this notification may be subject to penalties or fines.

This mandatory poster summarizes the Alaska Wage and Hour Act. Highly specific details regarding who this law applies to and who it does not apply to are listed. Circumstances where minimum wages does not apply include agriculture, domestic service, delivery people, etc. Requirements for overtime work and pay are detailed as well. This poster also details the conditions in which overtime pay is not required as well.

Summary of Alaska Wage and Hour Act Effective January 1, 2025, the Alaska minimum wage shall be $11.91 per hour. Alaska Statute 23.10.050 – 23.10.150 establishes minimum wage and overtime pay standards for employment subject to its provisions. These standards are generally applicable to all employees. School bus drivers, however, shall receive at least two times the Alaska minimum wage. Other exceptions to the minimum wage requirement follow. Alaska minimum wage and overtime requirements do not apply to any individual employed as follows: In agriculture; In the taking of aquatic life; or the hand picking of shrimp; In domestic service (including babysitting) in or about a private home; By U.S., state or local governments (i.e., political subdivisions); In voluntary service in the nonprofit activities of a religious, charitable, cemetery, educational or other nonprofit organization which are related only to the organization’s nonprofit activities; In a bona fide executive, professional or administrative capacity as defined in regulations of the Commissioner of Labor and Workforce Development and in the FLSA; or in certain computer occupations, or as an outside salesman, or as any salesman working on a straight commission basis; Youth under age 18 employed part-time for not more than 30 hours in any week; An individual who is employed by a motor vehicle dealer and whose primary duty is to (a) receive, analyze or reference requests for service, repair or analysis of motor vehicles; (b) arrange financing for the sale of motor vehicles and related products and services that are part of the sale; or (c) solicit, sell, lease or exchange motor vehicles; An individual who provides emergency medical services only on a voluntary basis; serves with a full-time fire department only on a voluntary basis; or provides ski patrol services on a voluntary basis; A student participating in a University of Alaska practicum described under AS 14.40.065; A person licensed under AS 08.54 and who is employed by a registered guide or master guide licensed under AS 08.54 for the first 60 workdays so employed during a calendar year; An independent taxicab driver who establishes the driving area and hours, who contracts on a flat rate basis for use of the cab, permit or dispatch services, and who is compensated solely by the customers served; Solely as a watchman or caretaker on a premises out of operation for longer than four months; In delivery of newspapers to the consumer; In the search for placer or hard rock minerals; An individual engaged in activities for a nonprofit religious, charitable, civic, cemetery, recreational or educational organization where the employer-employee relationship does not, in fact, exist, and where services rendered to the organization under a work activity requirement of AS 47.27 (Alaska temporary assistance program); By a nonprofit educational or child care facility to serve in place of a parent of children in residence if the employment requires residence at the facility and is compensated on a cash basis exclusive of room and board at an annual rate of not less than $10,000 for an unmarried person; or $15,000 for a married couple. Overtime Hours The standard workweek shall not exceed 40 hours per week or eight hours per day. Should an employer find it necessary to employ an employee in excess of these standards, overtime hours shall be compensated at the rate of one and one-half times the regular rate of pay. Compensation at the overtime rate is not required in the following cases: By an employer who employs three or fewer people in the regular course of business; An individual employed in handling, packing, storing, pasteurizing, drying, canning, or preparing in their raw or natural state agricultural or horticultural commodities for market, or in making cheese, butter or other dairy products; Agricultural employees; An employee employed as a seamen; Workers engaged in planting or tending trees, cruising, surveying, bucking or felling timber, preparing or transporting logs or other forestry products to the mill, processing plant, railroad or other transportation terminal if the total number of employees in such lumber operations does not exceed 12; An individual employed as an outside buyer of poultry, eggs, cream or milk in their raw or natural state; Hospital employees whose duties include the provision of medical services; An employee under a flexible work hour plan which is included as part of a collective bargaining agreement; An employee under a voluntary flexible work plan if the employee and employer have signed a written agreement which has been approved by the Department (Overtime rates must be paid for work over 40 hours a week and over the hours specified on the flexible work hour plan not included in a collective bargaining agreement); A community health aide employed by a local or regional health organization as those terms are defined in AS 18.28.100; Work performed by certain flat-rate mechanics primarily engaged in servicing automobiles, light trucks, and motor homes, subject to certain and specific provisions (see AS 23.10.060(d)(17)); An employee of a small mining operation where not more than 12 people are employed, as long as the individual is not employed in excess of 12 hours per day or 56 hours per week during a period of not more than 14 workweeks in the aggregate in any calendar year during the mining season; An employee employed in connection with publication of a weekly, semiweekly or daily newspaper with a circulation of less than 1000; Casual employees as defined by regulations of the Commissioner of Labor and Workforce Development; A line haul truck driver for a trip exceeding 100 road miles one way if the driver’s pay includes overtime pay for work in excess of 40 hours per week or eight hours per day, and if the rate of pay is comparable to the minimum wage; Work performed by an employee under a voluntary written agreement addressing the trading of work shifts among employees, if employed by an air carrier subject to subchapter II of the Railway Labor Act (45 U.S.C.181-188), including employment as a customer service representative, subject to certain provisions (see AS 23.10.060(d)(18)); Work performed by a flight crew member employed by an air carrier subject to 45 U.S.C. 181-188 (subchapter II of the Railway Labor Act); A switchboard operator employed in a public telephone exchange that has fewer than 750 stations; An employee in otherwise exempted employment or a proprietor in a retail or service establishment engaged in handling telegraphic, telephone or radio messages under an agency or contract arrangement with a telegraph or communications company where the telegraph message or communications revenue of the agency does not exceed $500/month. NOTE: This is not a complete list of exemptions to minimum wage and overtime provisions. Refer to AS 23.10.055 and AS 23.10.060. The above text is intended for informational purposes only and is not to be construed as having the effect of law. Inquiries should be made to: Wage and Hour Administration, Alaska Department of Labor and Workforce Development, 1251 Muldoon Road, Suite 113, Anchorage, AK 99504 Phone: (907) 269-4909 Email: [email protected] Recordkeeping An employer shall keep for a period of at least three years all payroll information and records for each employee at the place of employment. Revised November 2024 Post in a Prominent Place

Get an Alaska all-in-one labor law poster

Instead of printing out pages of mandatory Alaska and Federal labor law posters, you can purchase a professional, laminated all-in-one labor law poster that guarantees compliance with all Alaska and federal posting requirements. Fully updated for April 2017!

Get All-In-One Poster Now

More Alaska Labor Law Posters

10 PDFS

10 PDFS

Minimum-Wage.org provides an additional nine required and optional Alaska labor law posters that may be relevant to your business. Be sure to also print and post all required state labor law posters, as well as all of the mandatory federal labor law posters.

| Alaska Poster Name | Poster Type |

|---|---|

| Required Notice to Employees - Unemployment Insurance | Unemployment Law |

| Required Emergency Information | Miscellaneous Law |

| Required Summary of Alaska Wage & Hour Act | Minimum Wage Law |

| Required Safety and Health Protection on the Job Poster | Job Safety Law |

| Required USERRA - The Uniformed Services Employment and Reemployment Rights Act | General Labor Law Poster |

List of all 10 Alaska labor law posters

List of all 10 Alaska labor law posters

Alaska Labor Law Poster Sources:

- Original poster PDF URL: https://labor.alaska.gov/lss/forms/Summary_of_Alaska_Wage_and_Hour_Act-01-2025.pdf

, last updated May 2020

, last updated May 2020 - Alaska Labor Law Poster Page at http://www.labor.state.ak.us/lss/posters.htm

- Alaska Department Of Labor and Workforce Development at http://www.labor.state.ak.us/lss/home.htm

Labor Poster Disclaimer:

While Minimum-Wage.org does our best to keep our list of Alaska labor law posters updated and complete, we provide this free resource as-is and cannot be held liable for errors or omissions. If the poster on this page is out-of-date or not working, please send us a message and we will fix it ASAP.