Maine Minimum Wage for 2023, 2024

Maine Minimum Wage for 2023, 2024

Contents :: Maine Minimum Wage

Maine's state minimum wage rate is $14.15 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage. The minimum wage applies to most employees in Maine, with limited exceptions including tipped employees, some student workers, and other exempt occupations.†

The Maine minimum wage was last changed in 2008, when it was raised $6.90 from $7.25 to $14.15.

The current minimum wage in Maine is $14.15.

The tipped wage is $7.08 per hour. If the employee’s direct wage combined with earned tips do not average, on a weekly basis, the state required minimum wage, the employer must pay the difference.

LOCAL MINIMUM WAGE

Portland

The 2024 minimum wage in the City of Portland is $15.00 per hour for hourly employees or $7.50 for employees who earn over $175 per month in tips (service employees).

Maine employers may not pay you under $14.15 per hour unless you or your occupation are specifically exempt from the minimum wage under state or federal law.

If you have questions about the Maine minimum wage, please ask us and someone will respond to you as soon as possible. Looking for a new job? Use the free Maine job search utility to find local job openings hiring now.

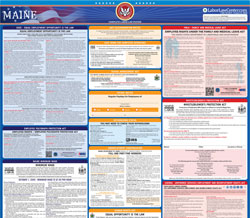

All Maine employers must display an approved Maine minimum wage poster in a prominent place to inform employees about the minimum wage and their worker's rights under Maine labor law.

Think the Maine Minimum Wage should be raised? LIKE on Facebook!

Maine Minimum Wage & Labor Law Posters

Maine Minimum Wage & Labor Law Posters

The Fair Labor Standards Act (FLSA) and Maine labor law requires all employers in Maine to visibly display an approved Maine minimum wage poster, and other Maine and federal labor law posters, to ensure that all employees are aware of federal and Maine labor law and overtime regulations. Failure to display a Maine labor law poster in the workplace can result in severe fines.

Get a Maine all-in-one labor law poster

Instead of printing out pages of mandatory Maine and Federal labor law posters, you can purchase a professional, laminated all-in-one labor law poster that guarantees compliance with all Maine and federal posting requirements. Fully updated for December 2017!

Get All-In-One Poster NowThe Maine minimum wage poster, and additional required Maine labor law posters, are also available on the Maine labor law posters download page.

Maine Overtime Minimum Wage

Maine Overtime Minimum Wage

All workers who put in over 40 weekly hours are entitled to a minimum wage of at least 1.5 times the regular applicable minimum wage (learn more about Maine overtime pay). Some states require workers who work over a certain number of daily hours to be eligible for this overtime rate as well (Maine law does not specify a daily overtime limit).

The FLSA guarantees all ME employees adequate overtime compensation for all qualifying overtime hours worked. If your employer does not pay adequate overtime wages, you can file an unpaid overtime claim with the Maine Department of Labor.

Maine Minimum Wage Exemptions

Maine Minimum Wage Exemptions

In addition to any Maine-specific minimum wage exemptions described above, the Federal Fair Labor Standards act defines special minimum wage rates applicable to certain types of workers. You may be paid under the Maine minimum wage if you fit into one of the following categories:

- Maine Under 20 Minimum Wage - $4.25 - Federal law allows any employer in Maine to pay a new employee who is under 20 years of age a training wage of $4.25 per hour for the first 90 days of employment.

- Maine Student Minimum Wage - $12.03 - Full-time high school or college students who work part-time may be paid 85% of the Maine minimum wage (as little as $12.03 per hour) for up to 20 hours of work per week at certain employers (such as work-study programs at universities).

- Maine Tipped Minimum Wage - See Here - Employees who earn a certain amount of tips every month may be paid a lower cash minimum wage, but must earn at least $14.15 including tips every hour. For more details, read about the Maine tipped minimum wage.

Local Minimum Wage Rates in Maine

Local Minimum Wage Rates in Maine

While Maine's state minimum wage is $14.15 per hour, there are localities that have set their own, higher minimum wages that apply to some or all employees within their jurisdictions. The following is a table of all Maine localities with established minimum wage laws.

| Locality | Applies To | Minimum Wage | Comparison to State |

|---|---|---|---|

| Portland | All employees | $14.00 | -$0.15 |

Frequently Asked Questions - Maine Minimum Wage & Labor Law

Frequently Asked Questions - Maine Minimum Wage & Labor Law

- What is the Maine minimum wage?

-

The current Maine minimum wage of $14.15 per hour is the lowest amount a non-exempt employee in Maine can legally be paid for hourly work. Special minimum wage rates, such as the "Maine waitress minimum wage" for tipped employees, may apply to certain workers.[1]

- How much will I earn working a minimum wage jobin Maine?

-

A full time minimum wage worker in Maine working 40 hours a week, 52 weeks a year, will earn $113.20 per day, $566.00 per week, and $29,432.00 per year1. The national poverty line for a family unit consisting of two people is $16,020.00 per year.

- What is the Maine under 18 minimum wage?

-

Maine employers may pay 18 year olds and minors the youth minimum wage of $4.25 for the first 90 days of employment. Other labor law exemptions for minors in Maine may exist.

- I still can't find the answer to my question about the Maine minimum wage!

-

If you have read the FAQ and still cannot find the information you need, please contact us with your question.

1 These earnings estimates do not account for the Maine income tax  , federal income tax, or local/municipal income taxes.

, federal income tax, or local/municipal income taxes.

2 Poverty line for a family of two in the lower 48 published 2016 by the U.S. Department of Health & Human Services

Labor Law Footnotes, Sources & Citations:

- The weekly earnings estimate of $566.00 is based on a standard 40-hour workweek

- The yearly earnings estimate of $29,432.00 is based on 52 standard 40-hour work weeks. Since most hourly employees don't work full time and/or take time off, actual yearly earnings will likely be lower.