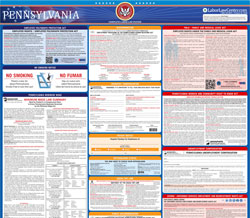

Pennsylvania

Form No. LLC-1 - Minimum Wage Law Poster and Fact Sheet

Mandatory

Pennsylvania

Form No. LLC-1 - Minimum Wage Law Poster and Fact Sheet

Mandatory

The Form No. LLC-1 - Minimum Wage Law Poster and Fact Sheet is a Pennsylvania minimum wage law poster provided for businesses by the Pennsylvania Department Of Labor & Industry. This is a required poster for all Pennsylvania employers, and any business that fails to post this notification may be subject to penalties or fines.

This is a state labor poster enforced by the state Bureau of Labor and Industry. It’s a mandatory post required of all employers within the state. It provides information about the prevailing rate of minimum wage payable to all covered employees within the state for every hour of service. The Pennsylvania minimum wage poster also highlights rights of all covered workers while also indicating responsibilities of the employers within the state. The poster defines employees who qualify and or are exempted, including workers and employers, from provisions of the state minimum pay law. It contains information about overtime pay and penalties for infraction. The poster also indicates where and how to file a related claim. The poster must be correctly posted by covered employers at a conspicuous place where all workers can access. Failure to comply with the posting and law can and may attract fines and or sanctions.

MINIMUM WAGE LAW SUMMARY MUST BE POSTED IN A CONSPICUOUS PLACE IN EVERY PENNSYLVANIA BUSINESS GOVERNED BY THE MINIMUM WAGE ACT Minimum Wage Rate Overtime Rate $7.25 per hour Effective July 24, 2009 Workers shall be paid 1½ times their regular rate of pay after 40 hours worked in a workweek (Except as Described) (Except as Described) The Pennsylvania Minimum Wage Act establishes a fixed Minimum Wage and Overtime Rate for employees. It also sets forth compliance-related duties for the Department of Labor & Industry and for employers. In addition, the Minimum Wage Act provides penalties for noncompliance. This summary is for general information only and is not an official position formally adopted by the Department of Labor & Industry. TIPPED EMPLOYEES: PENALTIES: An employer may pay a minimum of $2.83 per hour Failure to pay the legal minimum wage or other to an employee who makes $135.00 per month in violations may result in payment of back wages and tips. The employer must make up the difference other civil or criminal action where warranted. if the tips and $2.83 do not meet the regular Pennsylvania minimum wage. KEEPING RECORDS: EXEMPTIONS: Overtime applies to certain employment classifications. (see pages 2 and 3) Every employer must maintain accurate records of each employee’s earnings and hours worked, and provide access to Labor & Industry. SPECIAL ALLOWANCES FOR: Students, learners and people with disabilities, upon application only. LLC-1 REV 06-22 (Page 1) EXEMPTIONS FROM BOTH Minimum Wage and Overtime Rates • Labor on a farm • Domestic service in or about the private home of the employer • Delivery of newspapers to the consumer • Publication of weekly, semi-weekly or daily newspaper with a circulation of less than 4,000 when the major portion of circulation is in the county where published or a bordering county • Bona fide outside salesman • Educational, charitable, religious, or nonprofit organization where no employer-employee relationship exists and service is rendered gratuitously • Golf caddy • In seasonal employment, if the employee is under 18 years of age or if a student under 24 years of age is employed by a nonprof it health or welfare agency engaged in activities dealing with children with disabilities or by a nonprof it day or resident seasonal recreational camp for campers under the age of 18 years, which operates for a period of less than three months in any one year • In employment by a public amusement or recreational establishment, organized camp, or religious or nonprof it educational conference center, if (i) it does not operate more than seven months a year or (ii) during the preceding calendar year, the average receipts for any 6 months were not more than 33% of its average receipts for the other 6 months of such year • Switchboard operator employed by an independently-owned public telephone company which has no more than 750 stations • Employees not subject to civil service laws who hold elective off ice or are on the personal staff of such an off iceholder, are immediate advisers to the off iceholder, or are appointed by the off iceholder to serve on a policy making level • Executive, Administrative, and Professional employees, as def ined by the Department ALLOWANCES Wages paid to any employee may include reasonable cost of board, lodging and other facilities. This may be considered as part of the minimum wage if the employee is notified of this condition and accepts it as a usual condition of employment at the time of hire or change of classification. The wages, including food credit plus tips, must equal the current minimum wage. Board: Food furnished in the form of meals on an established schedule. Lodging: Housing facility available for the personal use of the employee at all hours. Reasonable Cost: Actual cost, exclusive of profit, to the employer or to anyone affiliated with the employer. LLC-1 REV 06-22 (Page 2) EXCEPTIONS from Minimum Wage Rates • Learners and students (bona fide high school or college), after obtaining a Special Certificate from the Bureau of Labor Law Compliance, (651 Boas Street, Room 1301, Harrisburg, PA 17121-0750) may be paid 85% of the minimum wage as follows: Learners: 40 hours a week. Maximum eight weeks Students: Up to 20 hours a week. Up to 40 hours a week during school vacation periods • Individuals with a physical or mental deficiency or injury may be paid less than the applicable minimum wage if a license specifying a rate commensurate with productive capacity is obtained from the Bureau of Labor Law Compliance, (651 Boas Street, Room 1301, Harrisburg, PA 17121-0750), or a federal certificate is obtained under Section 14(c) of the Fair Labor Standards Act from the U.S. Department of Labor EXEMPTIONS from Overtime Rates • A seaman • Any salesman, partsman or mechanic primarily engaged in selling and servicing automobiles, trailers, trucks, farm implements or aircraft, if employed by a non-manufacturing establishment primarily engaged in the selling of such vehicles to ultimate purchasers. (Example: 51% of business is selling as opposed to 49% in servicing such vehicles) • Taxicab driver • Any employee of a motor carrier the Federal Secretary of Transportation has power to establish qualifications and maximum hours of service under 49 U.S.C. Section 3102 (b)(1) and (2) (relating to requirements for qualifications, hours of service, safety and equipment standards) • Any employee engaged in the processing of maple sap into sugar (other than refined sugar) or syrup • Employment by a motion picture theatre • Announcer, news editor, chief engineer of a radio or television station, the major studio of which is located in: LLC-1 REV 06-22 (Page 3) • City or town of 100,000 population or less, if it is not part of a standard metropolitan statistical area having a total population in excess of 100,000; or • City or town of 25,000 population or less, which is part of such an area but is at least 40 airline miles from the principal city in the area • The hours of an employee of an air carrier subject to the provisions of Title II of the Railway Labor Act (Public Law 69-257, 44 Stat. 577, 45 U.S.C. § 181 et seq.) when: • the hours are voluntarily worked by the employee pursuant to a shift-trading practice under which the employee has the opportunity to reduce hours worked in any workweek by voluntarily offering a shift for trade or reassignment; or • the required hours of work, wages and overtime compensation have been agreed to either in a collective bargaining agreement between the employer and labor organization representing employees for purposes of collective bargaining or pursuant to a voluntary agreement or understanding arrived at between the employer and employee QUESTIONS/COMPLAINTS CONTACT: Bureau of Labor Law Compliance Altoona District Office 1130 12th Avenue Suite 200 Altoona, PA 16601-3486 Phone: 814-940-6224 or 877-792-8198 Bureau of Labor Law Compliance Harrisburg District Office 651 Boas Street, Room 1301 Harrisburg, PA 17121-0750 Phone: 717-787-4671 or 800-932-0665 COUNTIES SERVED: Armstrong Bedford Blair Cambria Cameron Centre Clarion Clearfield Adams Columbia Cumberland Dauphin Franklin Juniata Bureau of Labor Law Compliance Scranton District Office 201-B State Office Bldg. 100 Lackawanna Avenue Scranton, PA 18503 Phone: 570-963-4577 or 877-214-3962 Jefferson McKean Mifflin Potter Somerset Warren Westmoreland Lancaster Lebanon Montour Perry York Bucks Chester Delaware Montgomery Philadelphia Bureau of Labor Law Compliance Philadelphia District Office 110 North 8th St., Suite 203 Philadelphia, PA 19107 Phone: 215-560-1858 or 877-817-9497 Bureau of Labor Law Compliance Pittsburgh District Office 301 5th Avenue, Suite 330 Pittsburgh, PA 15222 Phone: 412-565-5300 or 877-504-8354 Clinton Elk Fayette Forest Fulton Huntingdon Indiana Allegheny Beaver Butler Crawford Erie Berks Bradford Carbon Lackawanna Lehigh Luzerne Lycoming Greene Lawrence Mercer Venango Washington Monroe Northampton Northumberland Pike Schuylkill Snyder Sullivan Susquehanna Tioga Union Wayne Wyoming MORE INFORMATION IS AVAILABLE ONLINE Additional information about the Minimum Wage Act is available online at: www.dli.pa.gov, PA Keyword: Minimum Wage. From the Web site you can submit a complaint form, find answers to frequently asked questions and read more about the Minimum Wage Act. Auxiliary aids and services are available upon request to individuals with disabilities. Equal Opportunity Employer/Program LLC-1 REV 06-22 (Page 4)

Get a Pennsylvania all-in-one labor law poster

Instead of printing out pages of mandatory Pennsylvania and Federal labor law posters, you can purchase a professional, laminated all-in-one labor law poster that guarantees compliance with all Pennsylvania and federal posting requirements. Fully updated for December 2017!

Get All-In-One Poster Now

More Pennsylvania Labor Law Posters

18 PDFS

18 PDFS

Minimum-Wage.org provides an additional seventeen required and optional Pennsylvania labor law posters that may be relevant to your business. Be sure to also print and post all required state labor law posters, as well as all of the mandatory federal labor law posters.

| Pennsylvania Poster Name | Poster Type |

|---|---|

| Required Form No. LIBC-500 (Rev 5-09) Workers' Compensation Insurance Posting | Workers Compensation Law |

| Required Form No. UC-700 Unemployment Compensation | Unemployment Law |

| Required Form UC-700 (ESP) Compensacion Por Desempleo | Unemployment Law |

| Required Form No. LLC-1 - Minimum Wage Law Poster and Fact Sheet | Minimum Wage Law |

| Required Fair Employment | Equal Opportunity Law |

List of all 18 Pennsylvania labor law posters

List of all 18 Pennsylvania labor law posters

Pennsylvania Labor Law Poster Sources:

- Original poster PDF URL: https://www.pa.gov/content/dam/copapwp-pagov/en/dli/documents/individuals/labor-management-relations/llc/minimum-wage/documents/llc-1.pdf

, last updated May 2020

, last updated May 2020 - Pennsylvania Labor Law Poster Page at http://www.dli.pa.gov/Pages/Mandatory-Postings.aspx

- Pennsylvania Department Of Labor & Industry at http://www.dli.pa.gov/

Labor Poster Disclaimer:

While Minimum-Wage.org does our best to keep our list of Pennsylvania labor law posters updated and complete, we provide this free resource as-is and cannot be held liable for errors or omissions. If the poster on this page is out-of-date or not working, please send us a message and we will fix it ASAP.