South Carolina

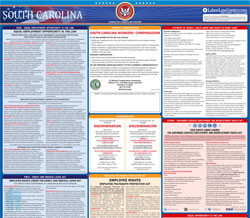

S.C Workplace Laws: Safety and Health on the Job Poster

Mandatory

South Carolina

S.C Workplace Laws: Safety and Health on the Job Poster

Mandatory

The S.C Workplace Laws: Safety and Health on the Job is a South Carolina job safety poster provided for businesses by the South Carolina Department Of Labor, Licensing and Regulation. This is a required poster for all South Carolina employers, and any business that fails to post this notification may be subject to penalties or fines.

This poster details more specifically South Carolina's laws on safety and health in the workplace. It declares that the State is the foundation of health and safety because it promulgates the laws on which practices are founded and by which employers and employees must comply.

More specifically, it asserts that in addition to the State having the responsibility of publishing and underwriting the law, employers have the responsibility of adhering to the laws concerning health and safety or they will face fines or potentially even be barred from operating in the State of South Carolina. Employees, too, have responsibilities, being themselves required to comply with all State and Federal laws on occupational health and safety as well as any directives issued by their employers in addition to standards codified in law. Employees will not also purposefully sabotage their employers in relation to health and safety standards and practices on the job.

South Carolina Workplace Laws: Notice to Employees THE STATE: Under the South Carolina Occupational Safety and Health Act, the state is responsible for the enforcement of occupational safety and health standards in all workplac - es, both public and private, within South Carolina. However, longshoring, shipbuilding, ship repairing and shipbreak - ing operations covered by the Longshoremen and Harbor Workers’ Compensation Act, as amended, remain under federal jurisdiction. EMPLOYERS: Each employer shall furnish to employees employment and a place of employment which are free from recognized hazards that are causing, or likely to cause, death or physical harm to his employees, and shall comply with occupational safety and health standards promulgated by the Director of Labor, Licensing and Regulation (LLR). Employers must report to OSHA all work-related fatalities within 8 hours, and all inpatient hospitalizations, amputa - tions, and losses of an eye within 24 hours. Reporting may be accomplished by telephone at (803) 896-7672 or in person at 121 Executive Center Drive, Suite 230, Columbia, SC 29211. EMPLOYEES: Each employee shall comply with occupa - tional safety and health standards and all rules, regulations and orders issued by the director of Labor, Licensing and Regulation which are applicable to his own actions and conduct. Any employee or representative may request an inspec - tion of place or site of employment. Any employee may file a complaint, either verbally or in writing. Complaint forms and filing information may be found on our website or will be provided, upon request, by the South Carolina Department of Labor, Licensing and Regulation. Employers and employees have the right to participate in inspections by means of bringing to the attention of the inspecting officer possible violations which exist in their area of work and the right to participate in the walk-around inspection. The inspecting officer shall have the right to determine the number of persons participating in the walk- around inspection. Under state law, when the authorized representative of the employees accompanies the inspecting officer during a walk-around inspection, he shall not suffer any loss of wag- es or other benefits which would normally accrue to him. Where there is no authorized representative, the inspecting officer will consult with a reasonable number of employees concerning matters of safety and health in the workplace. DISCRIMINATION: State and federal laws prohibit dis - crimination against any employee if he files a complaint or causes any proceeding under or related to this Act or is about to testify in any such proceedings or because of the exercise by any employee on behalf of himself or others of any right afforded under state and federal law. The director of Labor, Licensing and Regulation or the nearest federal OSHA offices must be notified within thirty (30) days after such discriminatory act occurs. State and local government employees should file such complaints with the director of SC Department of Labor, Licensing and Regulation. A pub- lic sector employee believing that he has been discharged or otherwise discriminated against by any person in viola - tion of Section 41-15-510 may proceed with a civil action pursuant to the provisions contained in Chapter 27, Title 8. CITATIONS: Citations listing the alleged violations during an inspection will be mailed to the employer with reason - able promptness. State law requires such citations be promptly posted at appropriate places for employee infor - mation for three days, or until the violations are corrected, whichever is later, to warn employees of dangers that may exist. PENALTIES: An employer may be assessed a penalty up to $7,000 dollars for a non-serious violation. An employer who receives a citation for a serious violation may be assessed a penalty up to $7,000 dollars for each such violation. Any employer who willfully violates an occupational safety and health rule or regulation may be assessed a penalty not more than $70,000 for each violation. Any employer who willfully violates an occupational safety and health rule or regulation and the violation causes death to an employee shall be deemed guilty of a misdemeanor and, upon conviction, be punished by fine, imprisonment or both. For more information, contact:South Carolina Department of Labor, Licensing and Regulation Office of OSHA Compliance PO Box 11329, Columbia, SC 29211-1329 803-896-7665, http://www.scosha.llronline.com/ Under a plan approved November 30, 1972 by the U.S. De - partment of Labor, Occupational Safety and Health Admin- istration (OSHA), the State of South Carolina is providing job safety and health protection for workers throughout the State. Federal OSHA will monitor the operation of this plan to assure that continued approval is merited. Any person may make a complaint regarding the state administration of this plan directly to the Regional Office of OSHA, U.S. Department of Labor, 61 Forsyth Street SW, Room 6T50, Atlanta, Georgia 30303. For more information, contact: wSC Dept. of Labor, Licensing and Regulations, 803-896-4380, www.llronline.com wSC Department of Employment and Workforce, 803-737-2400, www.dew.sc.gov wSC Human Affairs Commission, 803-737-7800, 1-800-521-0725, www.schac.sc.gov wSC Workers Compensation Commission, 803-737-5700, www.wcc.sc.gov THIS NOTICE MUST BE POSTED CONSPICUOUSLY. This poster is free of charge to all SC employers by contacting one of the agencies above. August 2018 Safety and Health Protection on the Job Employment Discrimination If you are injured on the job, you should: 1. Notify your employer at once. You can’t receive benefits unless your employer knows you’re injured. 2. Tell the doctor your employer sends you to that you’re covered by Workers’ Comp. 3. Notify the Workers’ Comp. provider in the box below or the Worker’s Comp. Commission at 803-737-5700 if you experience undue delays or problems with your claim. Workers’ Compensation: 1. Pays 100% of your medical bills and some other expenses. 2. Compensates you for 66 2/3% of your salary, limited to the maximum wage set by law, if you are unable to work for more than seven calendar days. We are operating under and subject to the SC Workers’ Compensation Act. In case of acci- dental injury or death to an employee, the injured employee, or someone acting in his or her behalf, must give immediate notice to the employer or general authorized agent. Failure to give such immediate notice may be the cause of serious delay in the payment of compensation to the injured employee or his or her dependents and may result in failure to receive any compensation benefits under the law. Unemployment Insurance This establishment may be covered by the S.C. Employment and Workforce Law. If you become unemployed, contact your local SC Works center for assistance with employment opportunities. If no job is immediately available, you may be eligible for unemployment insur\ ance. If only part time work is available, you may be eligible for partial benefits. Apply online anytime, anywhere at https://scuihub.dew.sc.gov/CSS/ A guide to applying for unemployment benefits can be found at https://dew.sc.gov/individuals/apply-for-benefits Workers Pay No Part of the Cost for Unemployment Insurance Unemployment Insurance Tax: Often unemployed workers tell us that unemployment insurance is due them\ “because they have paid for it.” In South Carolina, employees do not fund unemployment insurance through deduction\ s from pay. Employers fund unemploy - ment insurance through tax contributions. Social Security Tax Don’t confuse unemployment insurance with old age, survivors and disa\ bility insurance. The amount deducted from your wages as Social Security is your contribution to old-age, survivors\ and disability insurance. The employer con - tributes an equal amount, in addition to his payment of the full unemplo\ yment insurance tax. If you have lost your job due to domestic violence, there is a possibili\ ty you may be eligible for unemployment insurance benefits. Payment of Wages, Child Labor and Right-to-Work Laws Payment of Wages Act When an employee is hired, the employer must notify the employee in writing of: • the wages agreed upon • the normal hours the employee will work • the time and place wages will be paid • the deductions an employer may make from wages, including insurance Changes to these terms must be in writing at least seven (7) calendar days before they become effective. Employers must pay employees all wages due each pay period. Employers must also give employees an itemized state - ment showing gross pay and all deductions made each pay period and maintain records of wages paid for three years. Employers who violate the Payment of Wages Act are subject to a civil penalty of $100 for each violation. Em - ployees can recover up to three times the full amount of unpaid wages, costs, and attorney’s fees in a civil action. To report a suspected violation, or for recordkeeping or other questions involving the Payment of Wages Act, or to order a copy of the Payment of Wages Act, please contact the Office of Wages and Child Labor at the ad - dress and number listed below. Child Labor No employer in this state shall engage in any oppressive child labor practices. Oppressive child labor includes employment of any minor in any occupation declared by the director of Labor, Licensing and Regulation to be particularly hazardous or detrimental to the health or well being of minors. Oppressive child labor also includes employment of minors who are 14 or 15 years old under the following conditions: • During school hours • Before 7 a.m. or after 7 p.m. (9 p.m. during the period of summer break of the school district in which the minor resides) • More than 18 hours during school weeks • More than 3 hours on school days • More than 40 hours in non-school weeks • More than 8 hours on non-school days For details involving child labor provisions, please con - tact the Office of Wages and Child Labor at: SC Department of Labor, Licensing and Regulation Office of Wages and Child Labor PO Box 11329, Columbia, SC 29211-1329 Phone: 803-896-4470, www.llronline.com Right-to-Work The right to work of a person in South Carolina can - not be denied, interfered with, or abridged because the person belongs - or does not belong - to a labor union. An employer, labor organization, or other person who violates a worker’s rights under these provisions is guilty of a misdemeanor, and, upon conviction, must be punished by imprisonment for not less than 10 days nor more than 30 days, a fine of not less than $1,000 but not more than $10,000, or both. In addition, the employer, labor organization, or other person is subject to a lawsuit by the aggrieved worker. For more information call (803) 896-4470. Immigrant Worker The South Carolina Illegal Immigration and Reform Act requires all employers to verify the legal status of new employees and prohibits employment of any worker who is not legally in this country and authorized to work. After July 1, 2009, all businesses in South Carolina are imputed a South Carolina employment license which permits an employer to hire employees. The imputed employment license remains in effect as long as the business abides by the law. Effective January 1, 2012, all South Carolina employers are required to enroll in the U.S. Department of Home - land Security’s E-Verify program and verify the status of new employees within three business days, using E-Verify. Failure to use E-Verify to verify new hires will result in probation for the employer or suspension/revo - cation of the employer’s business licenses. SC Workers’ Compensation Commission PO Box 1715, Columbia, SC 29202-1715 803-737-5700, www.wcc.sc.gov Workers’ Compensation South Carolina and federal laws prohibit discrimination on the basis of \ race, sex, age, religion, color, national ori - gin and disability. You also have the right to be free from discrimination for medical needs \ arising from pregnancy, childbirth, or related medical conditions. If you feel that you have been discriminated against because of these, c\ ontact the: South Carolina Human Affairs Commission 1026 Sumter Street, Suite 101, Columbia, SC 29201 Phone: 803-737-7800 or 1-800-521-0725 www.schac.sc.gov

Get a South Carolina all-in-one labor law poster

Instead of printing out pages of mandatory South Carolina and Federal labor law posters, you can purchase a professional, laminated all-in-one labor law poster that guarantees compliance with all South Carolina and federal posting requirements. Fully updated for December 2017!

Get All-In-One Poster Now

More South Carolina Labor Law Posters

9 PDFS

9 PDFS

Minimum-Wage.org provides an additional eight required and optional South Carolina labor law posters that may be relevant to your business. Be sure to also print and post all required state labor law posters, as well as all of the mandatory federal labor law posters.

| South Carolina Poster Name | Poster Type |

|---|---|

| Required Discrimination Poster | Workers Rights Law |

| Required Discrimination Poster (Updated PAA/Accommodations) | Workers Rights Law |

| Required Workers' Compensation Poster | Workers Compensation Law |

| Required S.C Workplace Laws: Safety and Health on the Job | Job Safety |

| Required DLLR Required Workplace Poster | General Labor Law Poster |

List of all 9 South Carolina labor law posters

List of all 9 South Carolina labor law posters

South Carolina Labor Law Poster Sources:

- Original poster PDF URL: https://llr.sc.gov/wage/pdf/2018laws.pdf

, last updated May 2020

, last updated May 2020 - South Carolina Labor Law Poster Page at http://www.llr.state.sc.us/aboutus/index.asp?file=posters.htm

- South Carolina Department Of Labor, Licensing and Regulation at http://www.llr.state.sc.us/index.asp

Labor Poster Disclaimer:

While Minimum-Wage.org does our best to keep our list of South Carolina labor law posters updated and complete, we provide this free resource as-is and cannot be held liable for errors or omissions. If the poster on this page is out-of-date or not working, please send us a message and we will fix it ASAP.