Utah

Unemployment Insurance Notice to Workers

Mandatory

Utah

Unemployment Insurance Notice to Workers

Mandatory

The Unemployment Insurance Notice to Workers is an Utah unemployment law poster provided for businesses by the Utah Labor Commission. This is a required poster for all Utah employers, and any business that fails to post this notification may be subject to penalties or fines.

This poster declares that employees in the State of Utah are covered under the provisions of the Utah Employment Security Act for unemployment insurance purposes, unless the Act specifically exempts them (which occurs if employees fall into certain, albeit obscure, categories delineated in the Act). The poster goes on to detail for readers how to file for unemployment insurance benefits in Utah. In addition, it describes how to file for unemployment insurance benefits even after receiving workers? compensation benefits.

Further, it notes that one does not a need a separation notice from an employer to file for unemployment benefits. Further still, it states that benefits amounts paid out are determined proportionally to the wages an employee received while he or she still stood as such. The poster goes on to warn readers of the danger of being self-employed and encourages anyone who falls into that category to contact the Department of Workforce Services to discuss options for coverage. Further, the poster lists several programs, contact options, and links to aid anyone in need of job or unemployment insurance benefits. Anyone in need of help with such matters is encouraged to contact the Utah Department of Workforce Services (contact information is provided on the poster). Finally, the poster details standards with which employers in the State of Utah must comply in order to legally operate there.

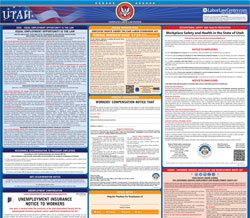

09-22E-0312 UTAH DEPARTMENT OF WORKFORCE SERVICES UNEMPLOYMENT INSURANCE NOTICE TO WORKERS Your work is covered under the provisions of the Utah Employment Security Act for unemployment insurance purposes, unless specifically exempted by the Act. Unemployment insurance specifically provides payments to qualified worke\ rs who are unemployed through no fault of their own and are able, availa\ ble, and seeking full-time work. It is not public assistance , Social Security, or a disability payment. Benefits are based upon your previous earning\ s—not on economic need. The funds to pay unemployment benefits are paid by your employer. No deductions are made from your wages. FILING FOR UNEMPLOYMENT INSURANCE BENEFITS To receive unemployment benefits you may file your claim online at jobs.utah.gov, select “Unemployment Benefits,” then choose “File New or Reopen Claims.” You may also call the Claims Center at: Salt Lake/South Davis Counties – (801) 526-4400; Weber/North Davis Counties – (801) 612-0877; Utah County – (801) 375-4067; elsewhere in Utah and out-of-state – (888) 848-0688. No benefits will be paid for weeks prior to the week in which you file your claim. You should, therefore, file immediately after becoming unemployed or when your work hours are reduced to less than full-time. FILING AFTER RECEIVING WORKER’S COMPENSATION BENEFITS If you are separated from employment due to a work-related illness or injury for which you have received Worker’s Compensation, your rights to unem - ployment benefits may be preserved for up to THREE YEARS from the date of your injury. In order to use wages earned prior to such an injury or ill - ness, you must file a claim for unemployment benefits within 90 DAYS of your doctor’s release to full time work. SEPARATION INFORMATION At the time you are separated from your job, you should request information as to the reasons for your separation. You do not need to have a separation notice to file a claim. Both you and your employer will be requested to provide statements explaining the reason for your separation. WAGES DETERMINE BENEFIT AMOUNT The amount of your unemployment benefits will be determined from your wa\ ges in covered employment. “Wages” are all payments for personal services performed such as salaries, commissions, bonuses, tips, and the cash val\ ue of goods and services received for services performed. Tips received but not reported to your employer generally cannot be used to determine your une\ mployment benefits. SELF-EMPLOYMENT If you are classified as “self-employed” (independent contractor), you may want to discuss this with your employer and have your status reviewed by DWS. Work performed in “self employment” cannot be used for unemployment benefits. You are “self-employed” if your work is performed without direction and control and you are in your own established business. This generally means you are properly licensed in business, perform similar services for others, maintain proper accounting records and business reports, pay self-employment taxes, and provide for insurance. ONLINE SERVICES Access our web site jobs.utah.gov to search for jobs, find out about available programs, and obtain econo\ mic information. NO FEE EMPLOYMENT SERVICES DWS services are available on our web site at jobs.utah.gov/employer or by going to any of our Employment Centers listed below. Employment servic - es include job referrals, career counseling, workshops, employer recruitment, Veterans’ services, labor market information, and job training/internships. Supportive services include food stamps, financial assistance, medical assistance, childcare assistance, unemployment assistance, emergency assistance, referrals to community, and other resources. Our Job Connection Rooms provide Internet access along with Information Specialists to assist you in accessing services and resources. Fax and copy machines are also available. jobs.utah.gov INFORMATION FOR EMPLOYERS Utah law requires that each employee’s wages must be reported each quarter with the regular quarterly contribution (tax) report. All wage and separation information and correspondence must include your unemployment insurance registration number. You must also maintain and make available records of wages and separation information on all workers for at least four (4) calendar years. When an unemployment claim is filed by a former employee, the Department of Workforce Services will send Form 606 “Notice of Claim Filed.” This notice will provide an opportunity for you to report details of the reason for the claimant’s separation and, in some cases, to request relief of potential charges. You will also receive a Form 65 “Employer Notice of Potential Liability” showing any wages from your firm being used on the claim and your firm’s potential benefit costs. If you have classified or contemplate classifying any of your workers as “self-employed” (independent contractors), notify the Department in order that a proper determination of status can be made. By doing this, you may avoid unpaid contributions (tax) liabilities, interest, and penalties. Additional information is available in the “Employer Handbook” which you can access on the Internet at jobs.utah.gov/employer. In accordance with Section 35A-4-406(1)(b) of the Utah Employment Security Act, this notice must be permanently posted by each employer at suitable points (on bul - letin boards, near time clocks, etc.) in each work place and establishment. Beaver .................................. 875 North Main .................................. (435) 438-3580 Blanding ............................... 544 North 100 East ............................ (435) 678-1400 Brigham City ........................ 1050 Medical Drive ........................... (435) 734-4060 Cedar City ............................ 176 East 200 North ............................ (435) 865-6530 Clearfield .............................. 1290 East 1450 South ........................ (855) 222-7531 Delta ..................................... 44 South 350 East .............................. (435) 864-3860 Emery County ...................... 550 West Hwy 29 ............................... (435) 381-6100 Heber City ............................ 69 North 600 West, Ste. C ................. (435) 654-6520 Junction ................................ 550 North Main .................................. (435) 577-2443 Kanab ................................... 468 East 300 South ............................ (435) 644-8910 Lehi ...................................... 557 W. State Street ............................. (801) 753-4500 Loa ....................................... 18 South Main .................................... (435) 836-2406 Logan ................................... 180 North 100 West ........................... (435) 792-0300 Manti .................................... 55 South Main #3 .............................. (435) 835-0720 Midvale ............................... 7292 South State St ............................ (801) 567-3800 Moab .................................... 457 Kane Creek Blvd. ....................... (435) 719-2600 Nephi .................................... 625 North Main .................................. (435) 623-1927 Ogden .................................. 480 27th Street ................................... (801) 626-3100 Panguitch .............................. 665 North Main .................................. (435) 676-1410 Park City .............................. 1960 Sidewinder Dr., Ste. 202 ........... (435) 649-8451 Price ..................................... 475 West Price River Dr. #300 .......... (435) 636-2300 Provo .................................... 1550 North 200 West ......................... (801) 342-2600 Richfield ............................... 115 East 100 South ............................ (435) 893-0000 Roosevelt .............................. 140 West 425 South 330-13 ............... (435) 722-6500 Roy ....................................... 1951 West 5400 South ....................... (801) 626-3100 Salt Lake Metro ................... 720 South 200 East ............................ (801) 536-7000 Salt Lake So County ............ 5735 South Redwood Rd. .................. (801) 269-4700 South Davis .......................... 763 West 700 South W. Cross ............. (801) 626-3100 Spanish Fork ........................ 1185 North Chappel Drive ................. (801) 794-6600 St. George ............................ 162 North 400 East Bldg. B .............. (435) 674-5627 Tooele ................................... 305 North Main, Ste. 100 .................. (435) 833-7310 Vernal ................................... 1050 West Market Dr. ........................ (435) 781-4100 West Valley .......................... 2750 South 5600 West Ste. A ............... (801) 840-4400 STATE EMPLOYMENT CENTERS Equal Opportunity Employer/Program Auxiliary aids and services are available upon request to individuals with disabilities by calling (801) 526-9240. Ind\ ividuals with speech and/or hearing impairments may call Relay Utah by dialing 711. Spanish Relay Utah: 1-888-346-3162

Get an Utah all-in-one labor law poster

Instead of printing out pages of mandatory Utah and Federal labor law posters, you can purchase a professional, laminated all-in-one labor law poster that guarantees compliance with all Utah and federal posting requirements. Fully updated for April 2017!

Get All-In-One Poster Now

More Utah Labor Law Posters

6 PDFS

6 PDFS

Minimum-Wage.org provides an additional five required and optional Utah labor law posters that may be relevant to your business. Be sure to also print and post all required state labor law posters, as well as all of the mandatory federal labor law posters.

| Utah Poster Name | Poster Type |

|---|---|

| Required Pregnancy and Related Conditions under the Utah Antidiscrimination Act | Workers Rights Law |

| Required Workers' Compensation Notice for the State of Utah | Workers Compensation Law |

| Required Unemployment Insurance Notice to Workers | Unemployment Law |

| Required Workplace Safety and Health in the State of Utah | Job Safety Law |

| Required Utah Smoke Free Business Sign | Anti-Smoking Law |

List of all 6 Utah labor law posters

List of all 6 Utah labor law posters

Utah Labor Law Poster Sources:

- Original poster PDF URL: https://laborcommission.utah.gov/wp-content/uploads/2019/11/09_22E.pdf

, last updated May 2020

, last updated May 2020 - Utah Labor Law Poster Page at http://www.laborcommission.utah.gov/divisions/UOSH/RequiredPosters.html

- Utah Labor Commission at http://www.laborcommission.utah.gov/index.html

Labor Poster Disclaimer:

While Minimum-Wage.org does our best to keep our list of Utah labor law posters updated and complete, we provide this free resource as-is and cannot be held liable for errors or omissions. If the poster on this page is out-of-date or not working, please send us a message and we will fix it ASAP.